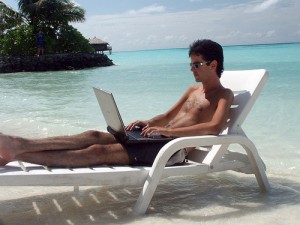

Have you ever dreamed of avoiding the tax man and ending up as relaxed as possible with no dues to your government or state? Being a tax nomad is a solution and here we will show you how to make that possible. So what is a tax nomad after all? This is a person who normally does not pay any sort of taxes in any country. Isn’t that impossible you might ask? Well it really is quite simple since the word nomad implies somebody who does not sit still. Usually a tax nomad comes from the very wealthy segment of society since these people can afford to travel quite a bit and they also have properties all around the world and are also able to hire the most expensive (but the best) tax consultants. So the option of being a tax nomad was not on for the normal working entrepreneur until pretty recently but this situation is now changing quite rapidly. The scenario of rock bottom prices for airline travel and excellent internet connectivity in several far flung places around the world has made the option of being a tax nomad one that is affordable for the creative person.

Have you ever dreamed of avoiding the tax man and ending up as relaxed as possible with no dues to your government or state? Being a tax nomad is a solution and here we will show you how to make that possible. So what is a tax nomad after all? This is a person who normally does not pay any sort of taxes in any country. Isn’t that impossible you might ask? Well it really is quite simple since the word nomad implies somebody who does not sit still. Usually a tax nomad comes from the very wealthy segment of society since these people can afford to travel quite a bit and they also have properties all around the world and are also able to hire the most expensive (but the best) tax consultants. So the option of being a tax nomad was not on for the normal working entrepreneur until pretty recently but this situation is now changing quite rapidly. The scenario of rock bottom prices for airline travel and excellent internet connectivity in several far flung places around the world has made the option of being a tax nomad one that is affordable for the creative person.

Here are some basic rules which we have come up with if you really want to become a tax nomad:

- You should not spend more than six months or 180 days during a period of 12 months in any country.

- Additionally you should not spend more than 90 days in a year as an average in any country

- You should also have any major interests in any country.

Let’s explain the basic rules of being a tax nomad. These obviously depend by far and large on your country of origin. But before taking the leap of faith becoming a tax nomad you should consult a tax expert in your country.

The 180 day rule

This is quite simple to understand. You should just avoid being more than 180 days in a particular country for a 12 month period. You should not have so much trouble achieving this either. You should embark on a few longish trips to some Far eastern low cost countries such as Thailand, Vietnam and Bali where the cost of living is much cheaper and you can even enjoy the sights while being a tax nomad cum traveller!

90 days on average

This rule is a bit more complex and is not so simple to understand or even achieve. Basically it means that you should not spend more than 90 days on average in any given country. This average is calculated over the last five years so you have to be pretty careful to stick to the numbers since it means that if you have spent more than 450 days in any given country for the last five years, this means that that country can actually tax you. This is a bit hard to avoid since when you start on your plan to become a tax nomad, you’ll probably have already spent more than 450 days in a country over the last five years. However there is an escape clause here since you can start off by residing in a low tax country for the first two years or so.

Do not hold any major interests in any country

The third rule is quite easy to understand. You should not have any major interests in any country and that is also a rule of residence. It is well known that if a country can claim that you have major interests located there (a factory, a company, bank deposits etc) then it can claim that you are a resident there. Of course the meaning of the word ‘major interests’ is hard to define clearly but if for example you have a house and family in that country, you can be said to have major interests and that country will definitely tax you. Keep it simple, use as little frills as possible and don’t leave any roots behind!

Another decision which you have to consider if you want to become a tax nomad is to make a complete break from your country. And the sooner you decide to do this the better. Your country is far more liable to run after you for tax purposes since it has all the information which is relevant about you and can also impose certain restrictions on your movements if it finds you owe it back taxes. So clear your dues and make the move as quickly as possible.

If you want to be a tax nomad you should also consider registering a company in another country, preferably a country which is considered as a tax haven. We will be providing a host of information on several of these countries as we go along so don’t forget to visit this page regularly for updates. First of all you will need to create an International Business Company or one which is known as an IBC to start operating. You should easily be able to register an IBC in a tax haven which also has strict financial privacy rules apart from lower taxes. When you have an IBC in place you should be able to operate in far greater freedom. Countries which offer this service include Belize, Isle of Man, Malta and Singapore. We will also be providing detailed information on how to set up an IBC in any one of these countries shortly.

Living the life of a tax nomad also opens up a host of opportunities. You get to travel and experience different lands and cultures but most importantly you open your business to a host of new opportunities. You can identify business opportunities which are waiting to be pounced upon and you can also enter new markets which you had never dreamed of before. And apart from all this, you pay little or no tax on your profits if you play your cards right. Just follow our easy to use guide and you will get there in no time. Happy travelling!